nebraska property tax calculator

The Federal or IRS Taxes Are Listed. In 2012 Nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable.

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

The median property tax in Nebraska is 216400 per year for a home worth the median value of 12330000.

. 15 Tax Calculators 15 Tax Calculators. Your average tax rate is 1198 and your marginal. For comparison the median home value in Lincoln County is.

Nebraska property tax calculator get link. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Tax Calculators Tools Tax Calculators Tools.

The credit may be claimed by filing an Amended Nebraska Property Tax Incentive Act Credit Computation Form PTCX. Counties in Nebraska collect an average of 176 of a propertys assesed fair. File a 2020.

For comparison the median home value in Lancaster County is. If you make 70000 a year living in the region of Nebraska USA you will be taxed 12680. For comparison the median home value in Douglas County is.

Its a progressive system which means that taxpayers who earn more pay higher taxes. The state income tax rate in Nebraska is progressive and ranges from 246 to 684 while federal income tax rates range from 10 to 37 depending on your income. AP Nebraska taxpayers who want to claim an income tax credit for some of.

This proration calculator should be useful for annual quarterly and semi-annual property tax proration at settlement calendar fiscal year. For comparison the median home value in Nebraska is. Simply close the closing date with.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The Federal or IRS Taxes Are Listed. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Enter the amount of property taxes you paid in the. Nebraska Income Tax Calculator 2021. The Nebraska Tax Calculator Lets You Calculate Your State Taxes For the Tax Year.

2021 Tax Year Return. The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called Nebraska Property Tax Credit Click here to learn more about this free subscription. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Resident individuals may claim the credit by filing a Nebraska income tax return for free over the internet using the DORs NebFile system. Important note on the salary paycheck calculator. There are four tax brackets in.

Nebraskas state income tax system is similar to the federal system. The Nebraska Tax Estimator Lets You Calculate Your State Taxes For the Tax Year. Today Nebraskas income tax rates range from 246 to.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Nebraska launches new site to calculate property tax refund.

Taxes And Spending In Nebraska

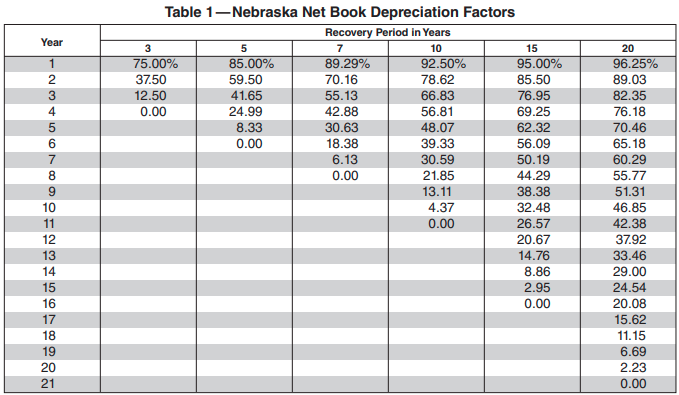

About Nebraska Personal Property

Property Tax Calculation Douglas County Treasurer

States With The Highest And Lowest Property Taxes Property Tax Tax States

Don T Die In Nebraska How The County Inheritance Tax Works

Property Tax Calculator Smartasset

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

Omaha Property Taxes Explained 2022

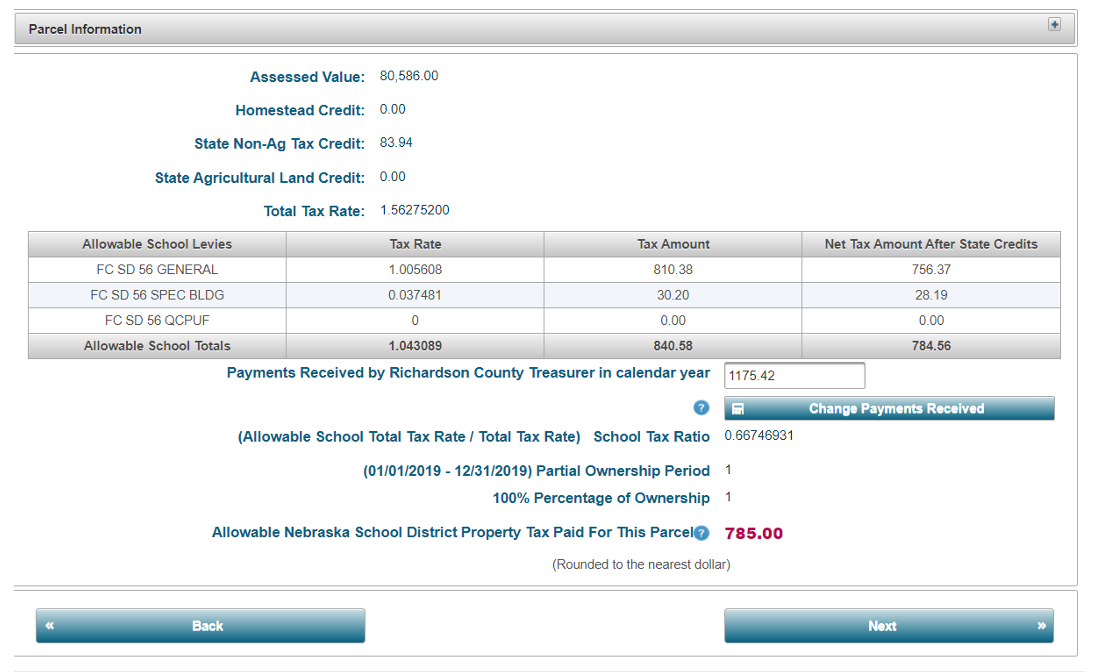

Property Tax Relief Through State Income Tax Center For Agricultural Profitability

Nebraska Real Estate Transfer Taxes An In Depth Guide

New Truth In Taxation Postcards Creating Confusion For Property Taxpayers In Lancaster County

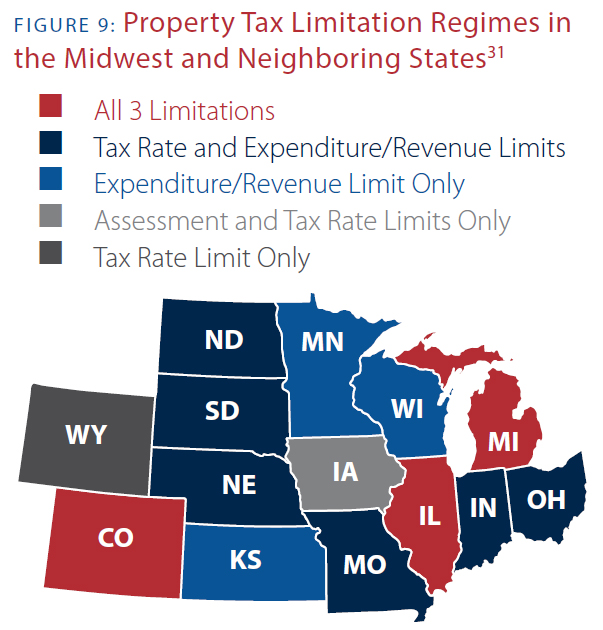

Get Real About Property Taxes 2nd Edition

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

Property Tax Calculation Douglas County Treasurer

Property Taxes By County Interactive Map Tax Foundation

Valuation Taxes Levied And Tax Rate Data Property Assessment

Nebraska Property Tax Calculator Smartasset

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price